Summary

Backdoor Roth is a way for high income people to sock away $6,000 after-tax per individual (or $12,000 for a couple) into a Roth IRA. You will pay the tax on the money that goes into the account but any future growth is tax free. Performing a backdoor conversion is a one way street and you are prohibited from undoing it. So think carefully before performing this trick.

What is Backdoor Roth IRA

If you are a high income earner you are probably not qualified to contribute to an IRA. The Internal Revenue Service considers you “Phased Out” (check the income limit here on the IRS website). The trick here is to use what is known as “Backdoor Roth IRA” conversion.

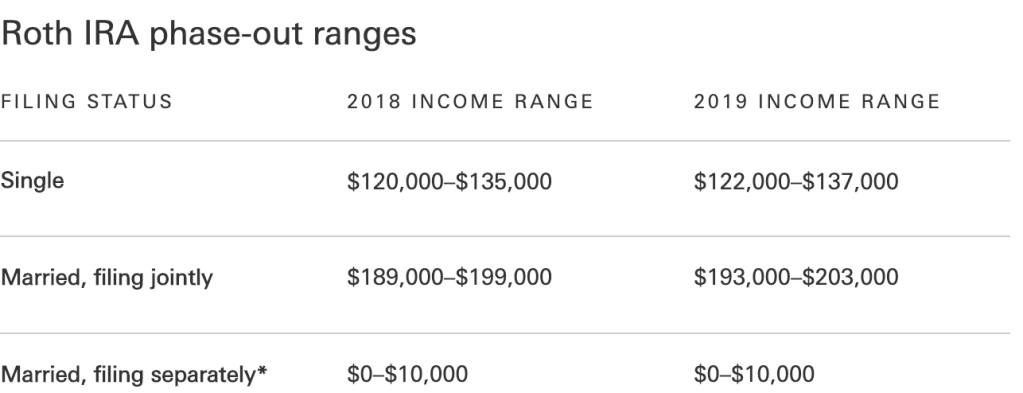

Income Limits

If you are a single income earner and making more than $137K or you are married and making over $203K you are not qualified to contribute to Roth IRA and you can only use the backdoor Roth technique that we are talking about

Here are the steps that you need to follow:

- Open a traditional IRA

- Move the money to a Roth IRA

- Make sure you do not have any other money in IRA (move them all to either Roth or a 401K)

- Profit $$$

The only hurdle I faced was that for my wife I had to start a new Vanguard account and the system did no allow me to move the funds after only 2 days. Apparently I had to wait for 7 days.

Step 1

You need to open two accounts on Vanguard.com. One traditional and one Roth IRA. I went through this step for my wife and it took me less than 5 minutes. After opening both accounts you need to fund your traditional account up to IRS’s limit. In 2021 the limit is $6,000 but I really recommend you fund it up to $5,990. The reason being if you forget the next step, your account starts gaining value and might exceed the IRS limit, complicating the process. If you fund your account to $6,000 and your account gains a cent or two as interest you can still convert to Roth IRA and just pay the tax for that two cents (which is effectively zero). I recommend you use a money market fund as your settlement fund.

Remember that you should not fund your Roth IRA. and Just use “add money later” when you open your Roth IRA account.

The rest is explained by Vanguard as follows.

When funds are coming from outside of Vanguard, you will need to wait seven calendar days after contributing before you can convert to a Roth IRA. Once your contribution has settled and the funds are fully available, you’ll be able to convert the assets to a Roth IRA.

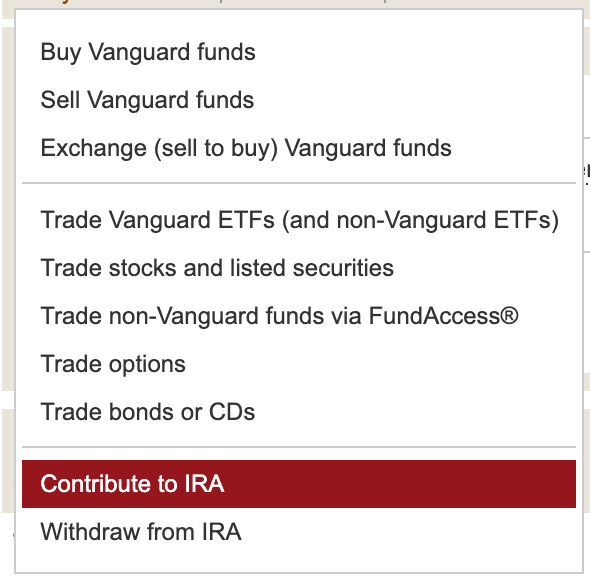

To convert to a Vanguard Roth IRA, follow these steps:

1. Log on to your account at vanguard.com.

2. From the “My Accounts” dropdown, select “Balances & Holdings.”

3. Under your pre-tax IRA,” select “Convert to Roth IRA” and follow the instructions. When you convert to a Roth IRA, your traditional or rollover IRA assets are distributed from the original account and rolled over to the Roth IRA. You’ll generally have to pay income taxes on the money you convert. If you’ve made only nondeductible contributions to your IRA and it’s the only pre-tax IRA you own, ordinary income tax would be due only on the earnings portion of the conversion. Roth IRA conversions are taxable within the calendar year they are completed, even if you’re converting previous year contributions. Vanguard will send you IRS Form 1099-R in January of the year following the conversion showing the amount that you distributed from your IRA. We’ll also mail you IRS Form 5498 by May 31 the year following the conversion reflecting the conversion into your Roth IRA. Please note that you’ll also need to file IRS Form 8606 with your income taxes to calculate your taxable amount and report your Roth IRA conversion. Pro Rata rule >> If you’ve made nondeductible contributions to your IRAs, a portion of your conversion amount–based on the percentage of your total IRA assets that is nondeductible–won’t be subject to tax. For example, if 20% of the contributions you’ve made to all your IRAs (which could include traditional, rollover, SIMPLE, and SEP-IRAs) were nondeductible contributions, then 20% of the amount you convert is not taxable and 80% is taxable. This applies even if you convert only assets in IRAs holding only deductible contributions. It also applies to any after-tax amounts from an employer-sponsored plan that you’ve rolled into an IRA. For more information on tax reporting requirements for Roth conversions, go to: http://personal.vanguard.com/us/insights/taxcenter/rothira-conversions Several factors can affect your Roth conversion decision. Therefore, you may want to consult with a qualified tax advisor before taking action. You can also get more information at: http://personal.vanguard.com/us/insights/taxcenter/planning/is-a-roth-conversion-right

It has been a few months since I have performed my Roth IRA and it has been a breeze.